Actionable 170 USD "free lunch"

Monster Beverage Corp $MNST - tender deadline 5 June 2024

My first Substackpost - experiment in the making

This is my first Substack post. Many of my friends and family live all over. This is my way to say I care and invite them for dinner or beers paid by tiny market inefficiencies.

I want to get my first post out quickly. So it’s a bit crude but I hope you will get the point.

1. Why this, why now

It’s called odd lot tender offers. I will explain in more detail later. Right now you need to know you can make 170 USD in around 5 days. Almost risk free.

Think of it as a mini personal experiment that seeks to educate my friends and family on how to regularly earn a few hundred bucks with very little work.

2. How to earn 170 USD today

So, these are the steps to make 170 USD of “risk-free” profit:

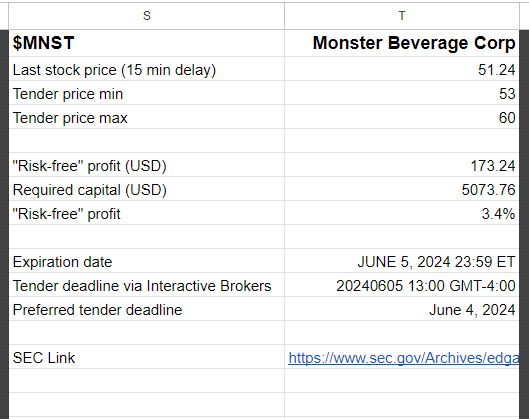

Step one - buy 99 shares of Monster Beverage Corp (ticker MNST) at 51.25 USD (or below 52 USD) per share. It will require you 5,075 USD.

Step two - tender your 99 shares at 53 USD per share by 4 June 2024 via your broker (highly recommend Interactive Brokers) - you pay 1 USD commission and tender shares for free

Step three - get (53-51.25) USD * 99 shares - 1 USD = 172.25 USD profit on your Interactive Brokers account for 5 minutes of work

3. How odd lot tenders work

It’s a long story. I might do a separate post explaining this in detail. Essentially, everything boils down to the following. Publicly listed companies often reduce their share count via buy backs. They may do so by declaring public tender offers. Some at specified fixed price. Some within the price range. They often include “odd lot” clauses. These clauses say that where the shareholders of that company own less than “odd lot” number of shares (typically its 99 shares), the owners who tender their shares will not be pro-rated during the auction process. This is advantageous because it creates tiny market inefficiencies favouring odd lot shareholders.

4. Not investment advice

There is no free lunch in life or investing. Markets can change. Investing is risky. I Don’t follow anything written in this post. Close the browser and walk away. Always do your own due diligence.

Over time, I might add more background and explanations on the mechanics of odd lot tender offers, reverse mergers, Morris Trust transactions, spin-offs and other special situations.

Hope over time I can teach some of my friends and family how to “fish” and educate them more about financial markets.