Actionable 640 USD opportunity - Talen Energy Corp

Talen Energy Corp (OTCM) odd lot tender opportunity - now trading at 109.5 USD

1. Tender overview

On 29 May 2024, Talen Energy Corporation (OTCQX: TLNE) announced that it has commenced a modified "Dutch auction" tender offer to purchase for cash up to an aggregate purchase price of $600,000,000 (and, at the Company's option, up to an additional $12,000,000) of its common stock at a price per share not less than $116.00 and not greater than $122.00, less any applicable withholding taxes and without interest, using available cash on hand.

Talen Energy Corp tender offer will have an odd lot provision as described in the Offer to Purchase.

“The Tender Offer will expire at 5:00 PM, New York City time, on June 27, 2024 (the "Expiration Time"), unless extended or earlier terminated. In order for stockholders to be eligible to receive the Total Consideration, such holders must validly tender their Shares at or prior to 5:00 PM, New York City time, on June 12, 2024, unless extended by Talen in its sole discretion (such time and date, as the same may be extended, the "Early Tender Time").”

2. Trade details

At the moment of this writing, $TLNE trades at around 109.5 USD per share. As a rule of thumb, I would not touch the situation if it makes at least 100 bucks per trade or 3% on the invested capital (time can vary - usually over 3 to 4 weeks).

So, these are the steps to exploit the potential market fluctuations in the next few days:

Step one - put out a Good-To-Date (ending cob 25 June 2024) Limit order (LMT in Interactive Brokers, i.e. an order to buy shares at a specified price or better) for 99 shares of Talen Energy Corp (ticker TLNE) at, say, 109.6 USD per share. If your order is filled, it will require you to pay 10,850 USD.

Step two - tender your 99 shares at 109.5 USD per share by 25 June 2024 via your broker (highly recommend Interactive Brokers)

Step three - get (116-109.5) USD * 99 shares - 1 USD profit on your Interactive Brokers account.

4. Interactive Brokers settings

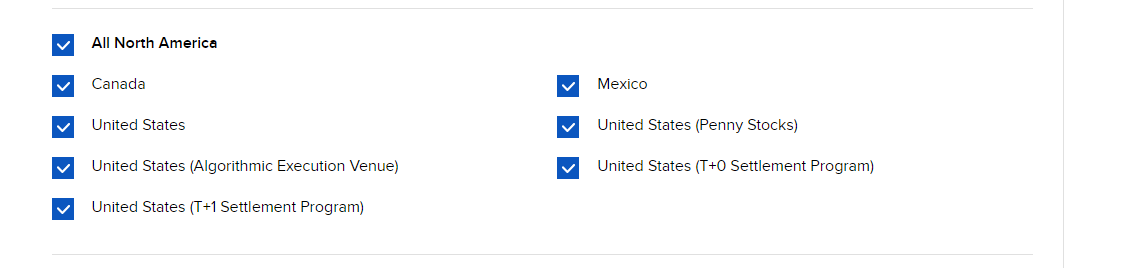

ote that $TLNE is listed on OTC Markets (Pink Sheets) as opposed to a well-known reputable excha

To purchase your 99 shares at Interactive Brokers

you would normally need to have respective trading permissions, which you can change in Settings tab of your client management interface

5. Tendering vs waiting optionality

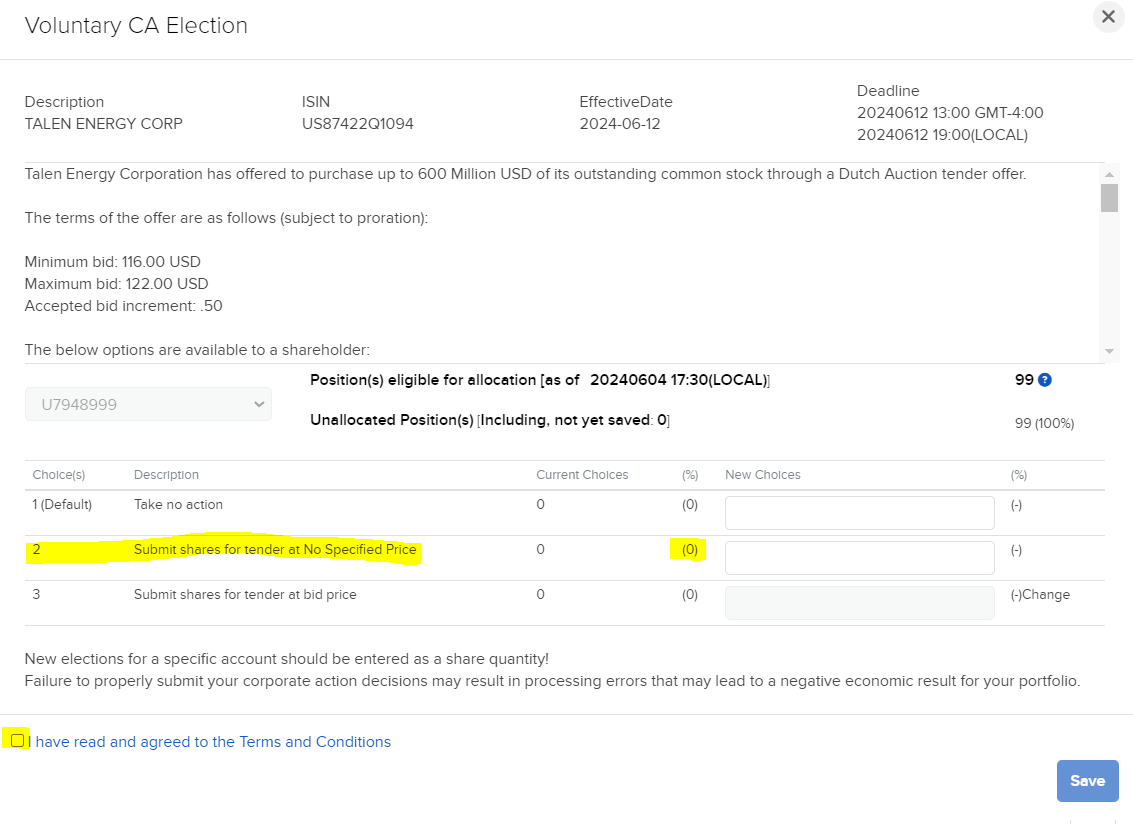

Normally, within minutes you can tender your 99 shares at a Non-Specified Price (i.e. the 116 USD lower floor specified in the tender documentation):

You can however wish to turn the gyrations of the market in your favour. The tender deadline is 27 June (see above). That’s why I might be waiting till ~ 25 June or so to exploit the optionality of price increase beyond the tender floor of 116 USD, in which case I will sell the shares on the open market.

6. Nuances and risks

Note that $TLNE is listed on OTC Markets (Pink Sheets) as opposed to a well-known reputable exchange and is NOT reporting to the SEC. Hence, the risk of the change of tender conditions, such as change in the price range or deadline extension, are WAY HIGHER than with plain vanilla odd lot tender offers.

Please note that the full details of the tender offer are not disclosed, which is why the tender offer conditions can offer nasty surpises.

Do your own due diligence. Always.

We have tendered our 99 shares of Talen Energy $TLNE at Specified Price cashing in a few hundred dollars of "risk-free" profit