Quick intro to "Reverse Stock Splits" - Ashford Inc $AINC

A 2,000 USD lying in the corner that are not worth picking up (yet)

1. Welcome to “Reverse Stock Splits”

This will be a short post. I want to get this idea quickly and leave my readers with some room for reading and self-educating. The idea presented herein boils down to the following. For many reasons, publicly listed companies may want to terminate or suspend its reporting obligations and go “dark”.

The key reasons are normally to reduce costs and eliminate compliance burdens. Under the U.S. listing rules, a U.S. company will need to have fewer than 300 stockholders.

This is exactly where “reverse stock splits” kick in. A “reverse stock split” is a corporate action that reduces the number of outstanding shares by merging them into a smaller number of proportionally more valuable shares.

For example, in a 1-for-10 reverse split, every 10 shares are combined into 1 new share with the share price multiplied by 10 to maintain the same market cap.

2. Ashford Inc. ($AINC)

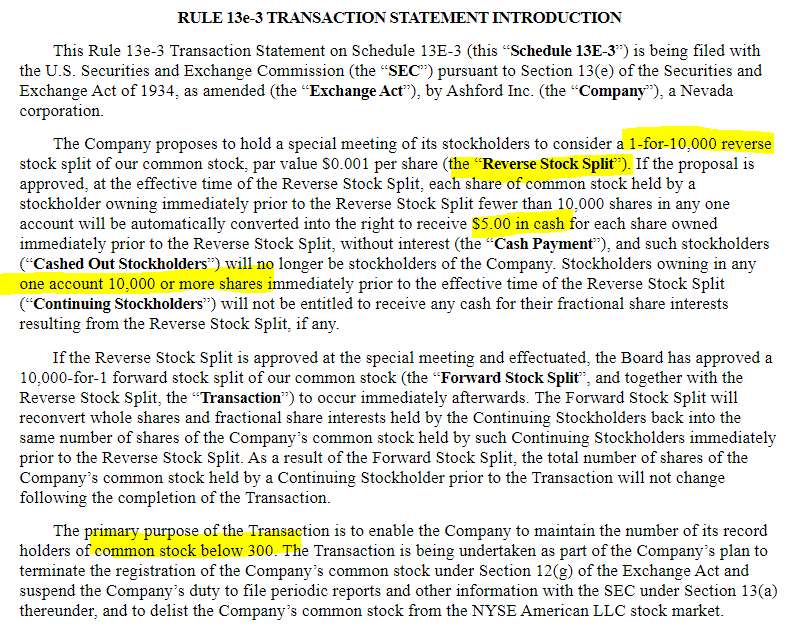

If 1-for-10 reverse split sounds a bit unconventional, think of 1-for-10,000 reverse stock split. This is what Ashford Inc is trying to accomplish through its announced Going Private Transaction.

Now, check out this disclosure:

What it broadly means is that those shareholders holding in one account less than 10,000 shares would be considered “Cashed Out Stockholders” at a fixed price of 5.00 USD in cash per pre-reverse-split share.

With AINC 0.00%↑ shares trading in the range 4.80 to 4.85 USD per share over the past few weeks, this trade could result in 1,500 USD to 2,000 USD of “risk-free” profit (please refer to the Disclaimer!).

3. Not actionable (at least yet)

There are multiple factors that need to be assessed in these types of situations. Level 1 thinkers would simply conclude that the money is just laying there and one just needs to pick it up.

“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.” Jim Rogers

The reality is more nuanced. The spread of 3.1% is too small (at least for now), and since it can still take a few weeks for the Transaction to get through, approved and executed, one’s IRR could be sub-optimal.

Corporate governance is important, and here Ashford Inc has a juicy story to tell.

Based on the current price and SEC filings, the above transaction does not appear to represent sufficiently attractive opportunity. This can, however, change rapidly.

Disclosure: Not a AINC 0.00%↑ shareholder at this moment.