Rinse and repeat - $SILA odd lot tender offer

Multiple shots on goal due to price fluctuations

There is no reason why I should be posting this SILA 0.00%↑ related post . In fact, it could have just as well been just a tweet. What I wanted to describe is an obvious and pretty trivial description of the mechanics of tender offers, which boils down to the fact that price volatility sometimes offers multiple shots at a goal.

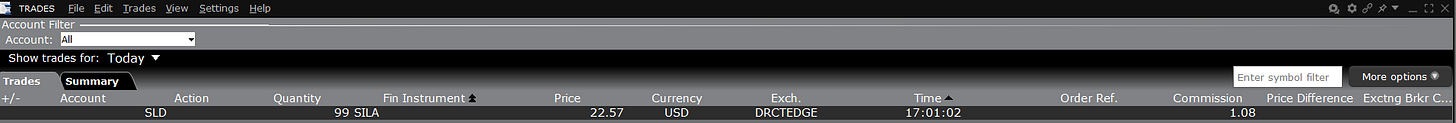

In SILA 0.00%↑ example, the price has almost reached the lower tender band of $22.60 USD, where it makes sense to simply sell the 99 shares pocketing almost the entire tender potential (which is most likely to be the lower range limit)

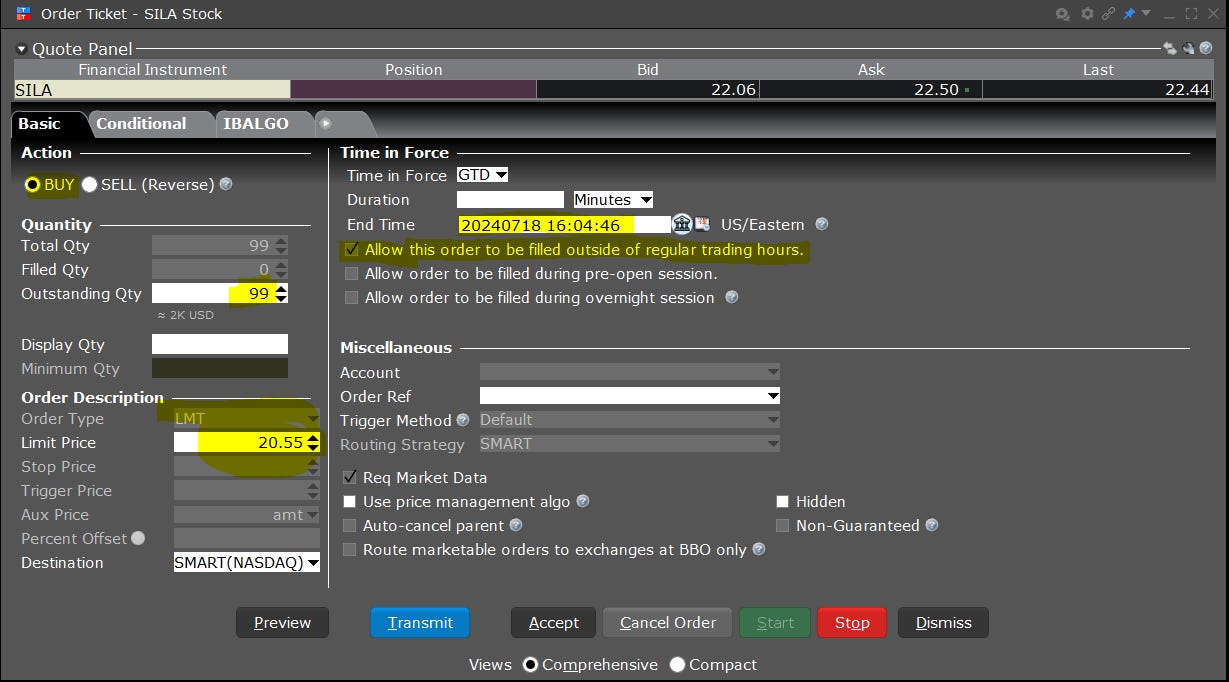

and placing a new limit order for 99 shares expiring a day or two before the actual tender deadline accepted by your broker. Just an illustration:

This rinse and repeat practice may sound pretty trivial (which it is), and I apologise if it resembles collecting pennies in front of a steamroller (in all honesty, it is actually a fair description).

At the same time, from the education viewpoint, one always needs to check the recent disclosures (such as this one, in $SILA’s case). Are there any recent material events? Is the price move of such a magnitude that it substantially increases the likelihood of the cancellation of or the change in the terms of the tender, such as the modification of the price range or, say, a potential extension of the deadline?

I guess the main takeaway from this unduly lengthy post is that market events and price fluctuations can sometimes create temporary inefficiencies that can be exploited and traded around more than once (or multiple times).

NOT INVESTMENT ADVICE. PLEASE DO YOUR OWN DUE DILIGENCE.

P.S. I must confess I am surprised and honoured to have around 40 new subscribers to my Substack. This newsletter was launched as a part-time project seeking to keep my friends and extended family about some low-hanging fruit being “offered” by the market. The idea was to put out very few well-defined trading ideas - mostly around odd lot tender offers, “going private”, reverse stock split and odd lot split off transactions. The logic behind was that those situations typically have a strong track record of “delivering” profitable trades (hence the arrogant-sounding name “free money investing”). Given that several subscribers have expressed interest in the work I put out, depending on my bandwidth, going forward I will gradually cover some additional situations, which will be riskier than, say, the plain-vanilla odd lots, such as liquidations, squeeze-outs, AIM rule 15 situations, privatisations, etc. etc.

thanks for your (present and future) hard work. It's great to have a stack that's dedicated to these low risk plays...........