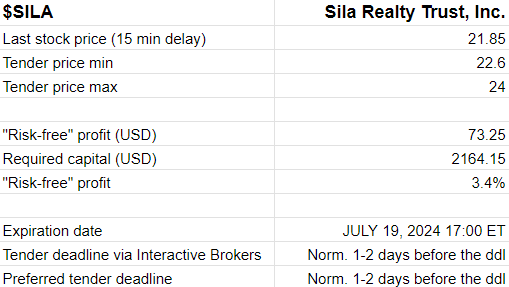

$SILA tender offer - 140 USD "free lunch"

Sila Realty Trust, Inc - $SILA odd lot tender offer - tender deadline 19 July 2024

1. Sila Realty Trust, Inc. odd lot tender offer

On 13 June 2024, Sila Realty Trust SILA 0.00%↑ has disclosed an offer to purchase up to $50 million of its shares outstanding in the range between $22.60 and $24.00 per Share, net to the seller in cash less the withholding of any applicable taxes and without interest. The conditions of the offer are available at the SEC EDGAR:

2. Details on $SILA’s odd lot tender

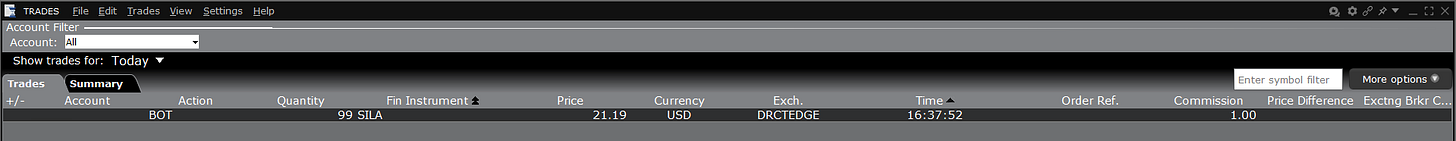

SILA 0.00%↑ has been volatile today, and I managed to get my order for 99 shares filled at 21.19 USD per share:

Given the volatility, it is highly likely that the stock goes even lower and that the opportunity will persist for weeks:

Step one - set a buy LMT order for 99 shares of Sila Realty Trust, Inc. (ticker SILA) at, say, 21.20 USD (or below that) per share. It will require you to put down 2,100 USD

Step two - tender your 99 shares at “No Specified Price” by the deadline via your broker (highly recommend Interactive Brokers due to reliability, automation and tender selections being free of charge)

Step three - get (22.6-21.2) USD * 99 shares - 1 USD = 137.6 USD profit on your Interactive Brokers account for 5 minutes of work

3. Not investment advice

There is no free lunch in life or investing. Markets can change. Investing is risky. I Don’t follow anything written in this post. Close the browser and walk away. Always do your own due diligence.

Since we have to wait until the deadline to tender our shares. If the stock price gets higher than the tender price range, will we be able to sell it in the market? Or we are obligated to do it once we tender shares with our broker (IBKR, e.g.) Thanks!

Thanks for sharing!

I have a question regarding the execution time. If we tender the shares now, when will it be executed? within a few days? Or we need to wait until the expiration date?

thanks a lot,